RKFS was the first platform I used to get onboarded to MF.

It made it a lot easier for me to invest and explore. RKFS helped me make better-informed decisions

I am very happy to be an investor through RKFS. When I ask a question, I receive an immediate reply from RKFS team

RKFS is an excellent platform for investing with all financial products under one roof

RKFS is transparent and data based. RKFS is trustworthy.

RKFS is a great way to control how much you save and invest through mutual funds as sip investment

RKFS was the reason I began investing. All the while, I was money in my bank account.

RKFS provides the best customer service. The team is polite, courteous, and prompt in responding

to queries. They have been a pleasure to work with, and I look forward to continuing the journey

for many more years. Bravo, RKFS Team!

I love the variety of Mutual Funds available.

I was able to choose the right fund for my long-term investments thanks to RKFS team

RKFS was easy to use and understand. The best part was that I received advice from the

RKFS team as an expert and friend. They also understood my risk-taking capacity as well as my paying capacity

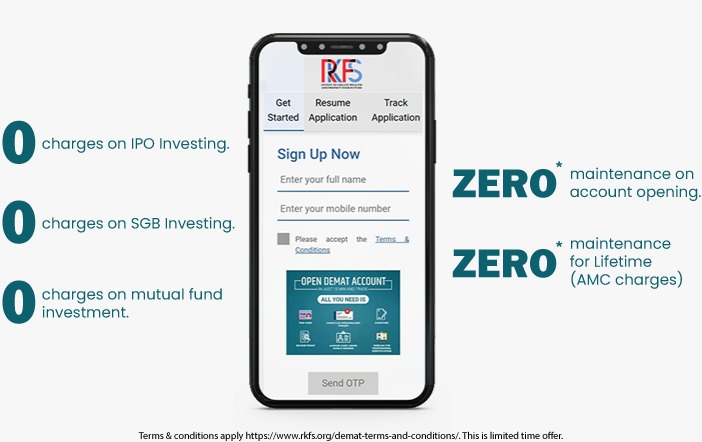

It is simple to open a Demat account with RKFS. It's easy to complete the

forms online and have them delivered by courier. Online, hassle-free process!

RKFS is the best choice if you are looking to open a Demat Account instantly.

It takes only 15 minutes to complete the entire process online

RKFS employees were so helpful throughout opening an account that it took me less than 20 minutes to complete.

RKFS introduced me to the SIP Plan. It is flexible and accessible.

This plan allows me to invest in funds, which is the best decision I have ever made.

RKFS Team, thank you so much.

SIP plan is an excellent option for those who want financial security

I did my lumpsum investment during initial days of the pandemic, the team was there to support

even when they were all working from home, my investment was done very promptly, and I am

earning a good return on it. Thanks team RKFS-

RKFS is an easy-to-use platform. I started investing in two plans.

Both have great features. But the SIP plan was my favorite. It allows you to invest in funds easily.

This plan allows me to invest and earn returns. RKFS has delivered an exceptional performance-

The website of RKFS is easy to navigate.

I can check all my transactions and holding by logging in to my account using the website

I got a SIP plan that would allow me to invest longer. The plan appealed to me because I wanted to maximize profits for a long-term investment of 10-12 years.

The sanjhi poonji app is easy to use and one can track the investment in a go. RKFS, thank you

RKFS helped me obtain the SIP plan. They gave me a detailed explanation of the plan.

The excellent returns and the monthly payment plan are very easy for me to manage.

They are always available to help me if I have any questions

The customer service team at RKFS is outstanding. Although I was still deciding about buying a SIP plan

for my business,

they helped me find the right one. They were very helpful, and I am glad I called them

They were very professional and pleasant to work with RKFS team members were extremely helpful

and recommended great investment plans according to the client's needs. Their phone manner was

polite and helpful; they listened well and provided me with a great deal on an investment

plan

RKFS made it easy for me to purchase a SIP plan last month.

The process was made easy by their excellent mutual fund team.

Their executive called me after I had registered my contact information online.

The whole process was very easy. RKFS, thank you so much.

I am one of RKFS's old client, the team help me every time I want to apply for an IPO.

Though the bidding is completely online and to be done by the client himself the team is

always there to help me

I wanted to invest in funds that were relatively safe.

RKFS helped me to learn about low-risk funds. RKFS provides excellent customer service

Through RKFS, I have gained extensive knowledge about various SIP plans.

I wanted to make investments that would provide high return on investment. With the help of RKFS team,

I could identify plans that fit my needs. RKFS's services exceeded my expectations.

Recently, I stared the SIP investment both for myself and my wife. The team is very

supportive and polite and answer all the queries and questions with patience and

clarifications. It's a long-term investment with many benefits. Much appreciated

I did my lumpsum investment during initial days of the pandemic, the team was there to support even when

they were all working from home,

my investment was done very promptly, and I am earning a good return on it. Thanks team RKFS

I wanted to invest in SGB and called Mr. RK Gupta who is the chairperson of RKFS, he informed

me that today the tranche is closing, within 15 minutes the team opened by demat account,

registered me on BSE STAR and within an hour my investment in SGB was done. Everything was

online, commendable team RKFS

The trading team is always there to support the clients, I am connected to RKFS since last many years,

the team also try to give the best advice and help in decision making

I am a connected with RKFS since more than 30 years, I am connected as an AP with them the transparency,

support and the ethics of the team flows from Mr Rk Gupta JI (bhai sahab ) to each and every team member.

Connected with RKFS is a matter of pride and joy for us as we are working day and night

together is collaboration with RKFS since more than last 25 years to make the future of

our clients financially safe and secure. The second generation in the family that is

the son and daughter of Mr Rk Gupta have inherited the vision , ethics and foresight

from their father in a very refined manner

Mr Bharat Lal Agarwal (Ghaziabad)